single life annuity vs lump sum

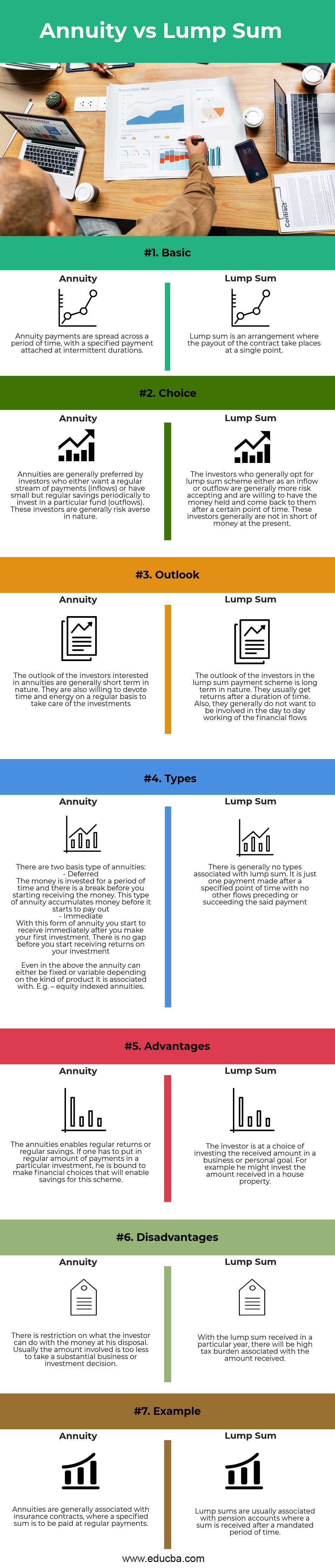

Your employer has also offered to pay you a lump sum of 300000 if you want to give up your monthly pension payments. In the end the payments from annuity add up to a larger sum in comparison to the lump sum.

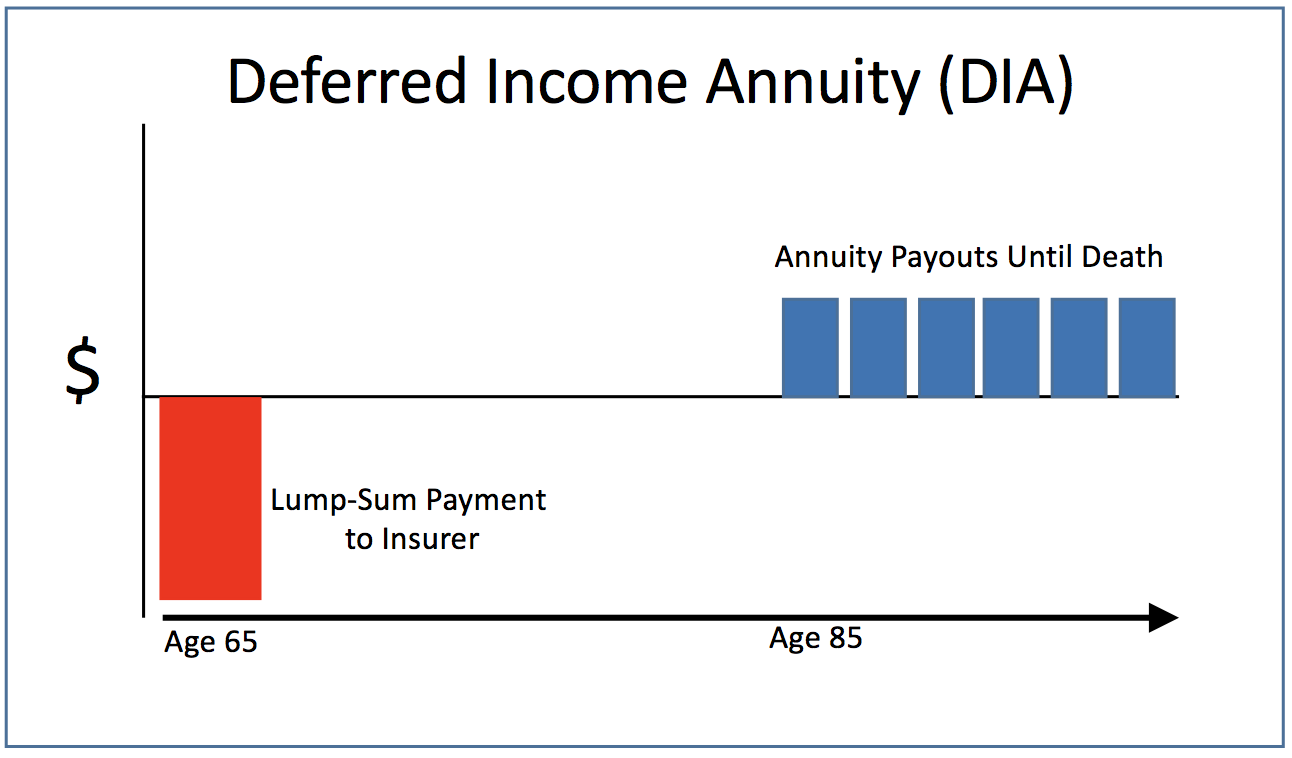

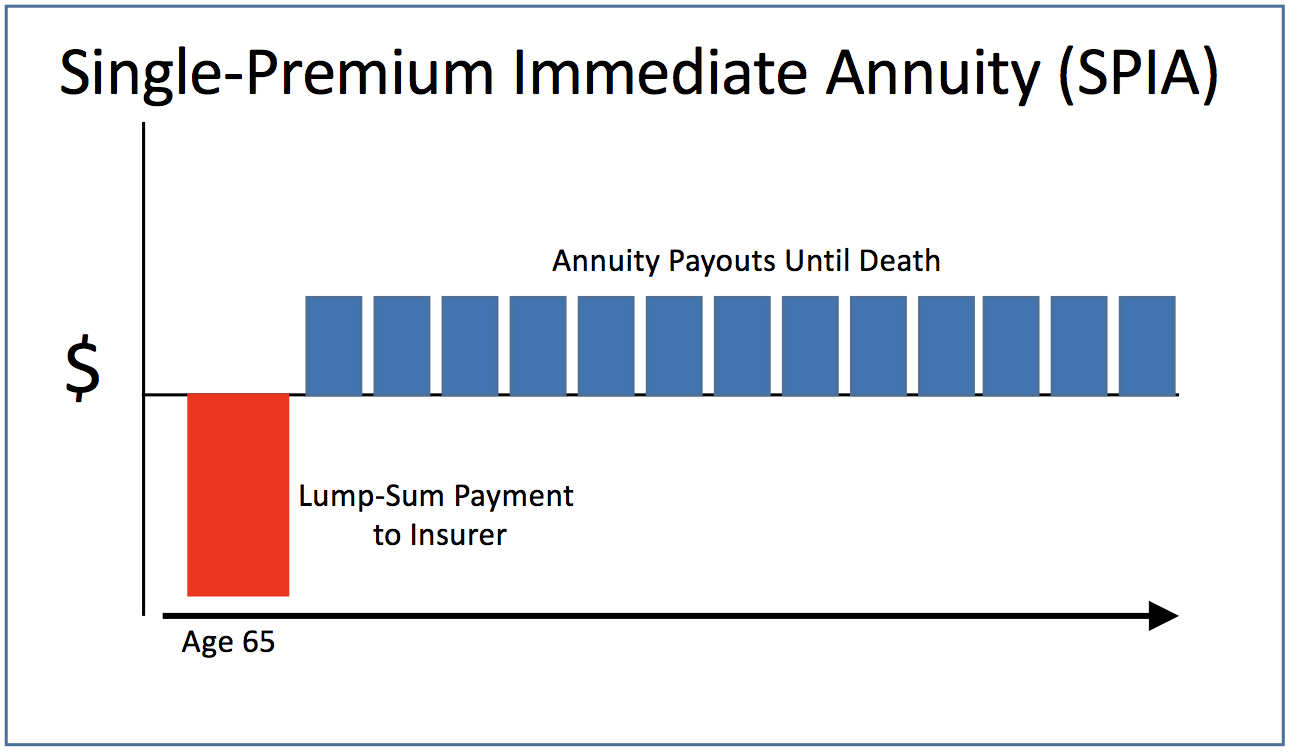

Income Annuities Immediate And Deferred Seeking Alpha

Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity.

. 50 joint and survivor annuity. Fixed Payments Eliminate The Impact Of Market Volatility. New Look At Your Financial Strategy.

The lump-sum payments attract tax all at once whereas the annuity attracts tax at a much. Get your exclusive free annuity report. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years.

In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on. A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. Truth is annuities are often the better deal says Bob Kargenian an Orange California-based financial adviser noting that companies offering these buyouts are doing so to.

Ad Learn some startling facts about this often complex investment product. Private Wealth Management 04302019. Use the Lump Sum vs.

Beat Your Bankers Rate. 100 joint and survivor annuity. Moreover the factor of inflation is also.

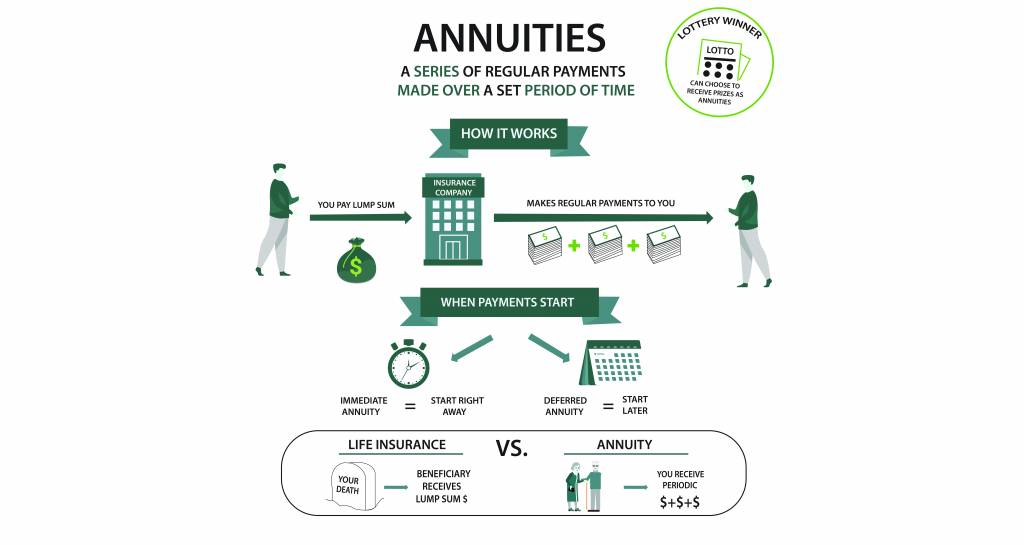

This tool compares two. Earn Up To 20X More. Ad Learn More about How Annuities Work from Fidelity.

A lump sum annuity payout may seem to be a good option especially if you wish to exercise complete control over your financial portfolio. By continuing payments to a beneficiary for a certain. According to a July 2012 article by.

A life annuity with period certain is a hybrid option that provides lifetime. Ad Safe Secure Compound Growth And The Highest Rates. Dont Ignore These Annuities.

SPIAs are commodities that need to. 11 Little-Known Tips You Must Know Before Buying. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Get Your Free Report Now. A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Is a lump sum offer from an employer a better choice than a pension annuity for life.

In other words if you withdrew 17640 per year in both investment earnings and principal on your 300000 lump sum youd need to earn an annual return of 06 on. Single life with term certain. All other benefits are paid as a monthly annuity.

PBGC pays lump sums only when a total benefit has a value of 5000 or less. Lump sum Weigh the options between lump sum and annuity payments. Life annuity with 10 years certain.

Ad Annuities provide guaranteed returns with no market risk. Difference between lump sum and annuity Choosing a lump sum will enable you to receive all the funds accumulated in your pension account right away in a single payment. Ad Learn some startling facts about this often complex investment product.

A premature death reduces the value of a single life annuity because payments end with the annuity holders death. If the annuity is fixed ie. Pays you the same exactly amount every month for the rest of your life you can simply compare the payout of the annuity with the payout you could.

Not all companies offer this option to employees. Dont Buy An Annuity Until You Review Our Top Picks For 2022. Visit The Official Edward Jones Site.

Find out what the required annual rate of return required would be for. If you take the 2500 per month then when you do. After the date of your first payment you cannot.

The former provides an immediate up-front amount say 300000 but the pension. Learn More About Annuities. Be sure to use a reasonable estimate of what your lump-sum investment might earn.

Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life. Today we think a hypothetical conservative portfolio of 20 equities 50 bonds. Ad Americans Are Replacing CDs And Savings Accounts With This New Bank Alternative.

The one-time lump-sum payout option included with pensions is calculated by the employer.

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Does An Annuity Plan Work For You Businesstoday

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

How Much Income Do Annuities Pay Due

Annuity Vs Lump Sum Top 7 Useful Differences To Know

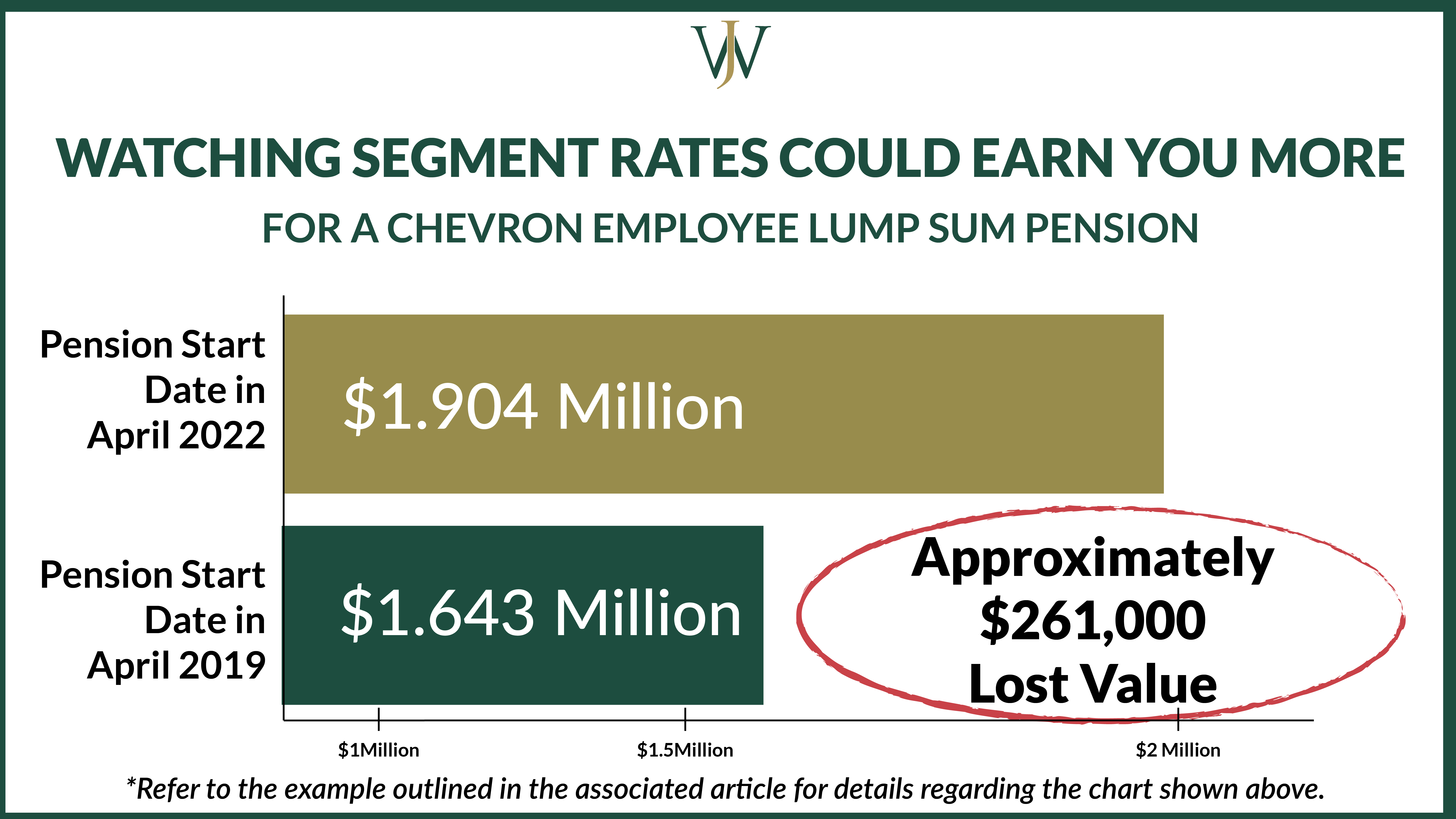

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Difference Between Annuity And Lump Sum Payment Infographics

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Beneficiaries Inherited Annuities Death

Income Annuities Immediate And Deferred Seeking Alpha

Strategies To Maximize Pension Vs Lump Sum Decisions

Annuity Payout Options Immediate Vs Deferred Annuities

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Annuity Beneficiaries Inheriting An Annuity After Death